Conversations are at the centre of any client relationship. The need for easy, flexible and transparent ways to interact are driving the digital transformation and will fundamentally reshape the banking industry. While internet banking and omnichannel interactions have created a world of convenience, clients are indicating that something is missing: personal interaction. Looking back on the long history of banking, which took root in Italy in the 15th century, it shouldn’t be forgotten that conversation was once the only possible interaction between client and banker. It is time to re-centre client-banker interaction at the heart of this relationship.

That’s where conversational banking can provide a new way to establish a relationship between the bank and its clients—and a new opportunity for banks to drive revenue.

Javier Puga, EVP Marketing at Unblu, and Jean-Philippe Bersier, Director – Business Development at ERI, discuss how the Unblu and ERI partnership can help banks automate, secure, and simplify their clients’ interactions to best create a meaningful and connected experience at each step of the customer journey.

What is Conversational Banking? Should we abide by its traditional definition?

Javier Puga – The industry defines conversational banking as interacting with a non-human interface (such as chatbots) to discuss your finances or seek advice. But at Unblu, we have a broader definition. We see conversational banking as using conversations—whether initiated by a human or a virtual assistant—to get to know clients and guide them through financial decisions.

In our opinion, if conversational banking is well-implemented, it will give banks the ability to increase interactions and sales opportunities through digital channels. In turn, this increases clients’ loyalty and will improve the quality of advice, service and client satisfaction.

Jean-Philippe Bersier – Shifting client expectations have deeply impacted the way banks address their clients’ needs for more convenience and personalisation. The speed at which technology is changing their sector has forced banks and financial institutions to modernise their business models. Personalised client servicing has become the main differentiator to help banks build trust and loyalty. Technology is instrumental in achieving this transformation and providing services that deliver convenience and simplify daily banking activities. Being omnichannel is crucial, but being able to bring the best of digital experience and human expertise goes beyond.

Is it all about digital?

Javier Puga – Human interaction in hybrid or fully digital processes definitely makes a difference, but this is also about efficiency. Namely, conversational banking reduces the number of more expensive interactions that need to take place. Having a bot that chats with a client at the beginning of a conversation allows banks to qualify the request, therefore obtaining a better understanding of the intent and quickly solving some of the most frequently asked questions.

What’s more, a well-implemented digital strategy will automate the decision of whether a query should be routed to an advisor, or if it can be handled by a machine. This will help to free up advisors so they can focus on valuable conversations with prospects and clients.

Jean-Philippe Bersier – Even though the majority of customers, and especially Millennials and Gen Z, appreciate digital channels, there always comes a point where the virtual presence of an advisor is absolutely essential. Without this, there is an obvious risk of seeing the conversation end abruptly. It is clear now that the importance of “humanising” digital channels shouldn’t be overlooked. Clients appreciate online services, but they still want a personal experience that comes with human conversations. This is especially true when they are analysing more complex financial products like investment products, or making decisions with a potential big impact in life.

Advisors can offer investment proposals suited to their clients’ specific objectives that are adapted over time. Seamless workflows will enable smooth interactions and information sharing, speeding up client acceptance processes. Streamlining processes will increase operational efficiency, so that advisors can focus on their clients.

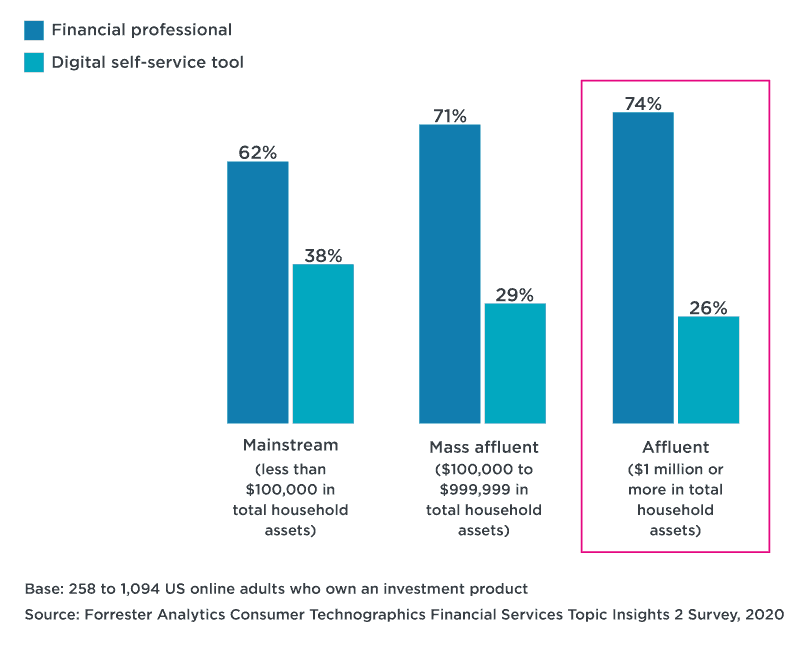

« Would you prefer to get financial advice from a financial professional or digital self-service tools? »

As clients become more affluent, the complexity of the financial advice they need compels them to favour human advisors over digital self-service tools. Private banking clients are primarily delegators and validators in Forrester’s self-directed investor framework, relying on financial professionals to make decisions for them.

Will Conversational Banking eventually replace advisors?

Javier Puga – There are those who believe that AI and chatbot technology will replace personal relationships over time. In our opinion, however, neither technology nor clients are ready for full automation. Years of helping banks transform their client service has shown us that there simply is no substitute for the human relationship. Bots have limited capabilities—right now, and for the foreseeable future.

Jean-Philippe Bersier – Banks have been facing digital transformation for a while now. The evolving needs and challenges of the markets have shown us that technology and especially AI is here to help banks get the right data at the right time, but human brains will be needed to actually analyse and use that data to implement the strategies relevant to clients.

What does it take to remain relevant in this new environment?

Javier Puga – In the financial marketplace, the competition is brutal. Banks can’t afford to make mistakes. Clients shouldn’t be “left alone” to browse and transact in a self-service universe, to the detriment of the client-bank relationship. This represents the growing gap between well-delivered self-service, and the genuine sharing of human knowledge, expertise and connection that clients are asking for. The challenge now is to bring them together so that the digital can facilitate personal and meaningful relationships, rather than leaving clients isolated.

Transactions like paying a bill or transferring money can fit into a client’s daily life asynchronously, whenever they choose to do it. But complex investment products require sitting down with a human being and getting advice. Technology can enable both transactions, and by bridging the digital-human gap, the two experiences will complement one another.

Jean-Philippe Bersier – A successful hybrid model is more than just digitising parts of the process to ease workloads; it’s also about enabling clients to autonomously and proactively take part in the management of their wealth. This enables faster decision-making thanks to insights being available on demand, and provides a more flexible connection with their advisor. For many, a successful hybrid model is one that achieves the optimal blend of digital and human services, allowing clients to benefit from greater transparency and access to insights whilst freeing advisors from many of the administrative tasks common in traditional service models. Managing and engaging with clients holistically is also paramount to that success, to offer them a connected and consolidated view of services that ensures consistency and relevance and builds trust.

These perspectives highlight the overall need for a joined-up approach that aims to simplify and connect the business to a more open world.

Conclusion

Banks represent decades of trust and expertise, and these human capacities will always be essential to banking. Nonetheless, much of the personal interaction between a client and their bank is shifting from physical branches to online spaces. Accordingly, banks now need to bridge these two scenarios. If they can leverage their established expertise and use their digital investments efficiently, they can deliver a client experience that rivals a branch visit.

To be relevant in the digital era, banks must seize the opportunity to become long-term financial partners for their clients. If they can evolve with the times by leveraging their financial expertise and the latest technology, clients will reward them with their trust and loyalty.

Jean-Philippe Bersier – ERI

Jean-Philippe Bersier is a long term career professional within the software and IT services business having held senior management positions for large prestigious international & Swiss companies. He has more than 15 years of experience in sales and consulting for large IT projects in the banking sector.

Jean-Philippe Bersier has joined ERI in 2002 as Business Development Director. He is in charge of the development of new markets and the management of the sales team. Before joining ERI, Mr Bersier was Sales Director for the Financial Markets Division at Cap Gemini Ernst & Young, Switzerland. He successively worked at Siemens Switzerland before accepting the position of Sales & Marketing Manager at Unicible (acquired by IBM). Mr Bersier holds a MBA in Economics from University of Lausanne (HEC).

About Unblu

Unblu helps the world’s leading banks and wealth management firms deliver an in-person experience online. The Unblu platform aids the role of advisors to interact and educate clients collaboratively through an ongoing digital conversation that is as efficient and convenient as it is secure and compliant.

The Unblu Conversational Platform increases client-advisor interaction while reducing costs and enriching the digital client experience. Unblu customers experience a 15%-20% increase in conversion rates, achieve a greater volume of client meetings, considerably increase client satisfaction, and produce a 90% recommendation rate. Unblu is transforming the future of banking.

Would you like to find out more? Visit www.unblu.com/resources to access webinars, testimonials and use cases about our features and solutions.

Javier Puga – Unblu

Javier Puga is the Executive Vice President Marketing at Unblu, the leading Conversational Platform for the Financial Industry. Prior to joining Unblu, Javier was Liferay’s Marketing Manager for Southern Europe. With more than 15 years of experience in PR, Marketing and digital transformation projects, Javier has advised large corporations worldwide to offer innovative and differential experiences to their customers. From Unblu, Javier works to make financial institutions understand the value that conventional banking technology can bring to their customers.